Latest News, Tips, Guides About Educations

Find your path. With 21K School, an Online School

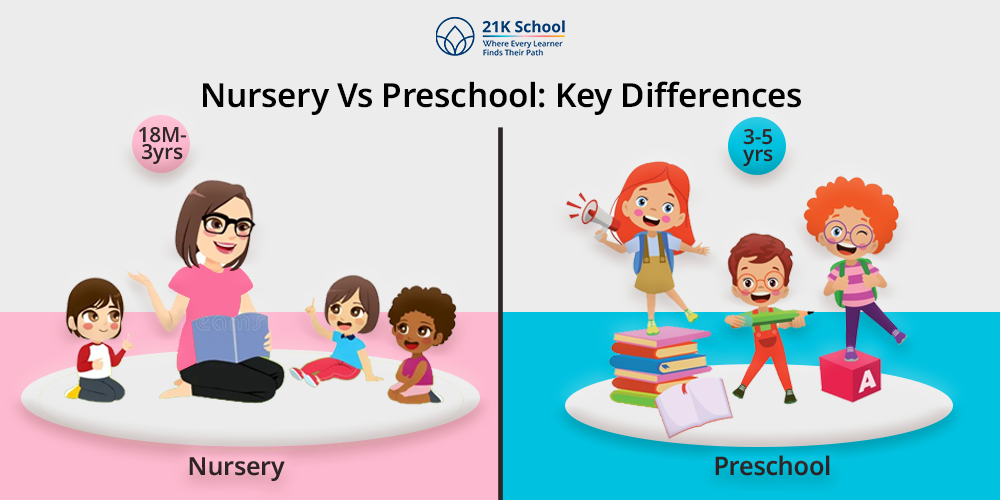

Nursery Vs Preschool: Which Is Right for Your Child?

Choosing the right early education option is one of the first big decisions parents face. Among the various choices, nursery… Read More

Last updated on: 04 Jul, 2025

Open School for Class 12: Admission, Eligibility & Benefits (2025 Guide)

Are you thinking whether taking admission to an open school in class 12 is possible or not? Open school for… Read More

Difference Between Open Learning System and Distance Education- A Detailed Comparison

Have you ever thought about why open learning systems and distance education are different concepts? Both open learning and distance… Read More

Open and Distance Learning: A Comprehensive Overview

Recent decades brought a huge change in the world of education due to technology development and changes in educational requirements…. Read More

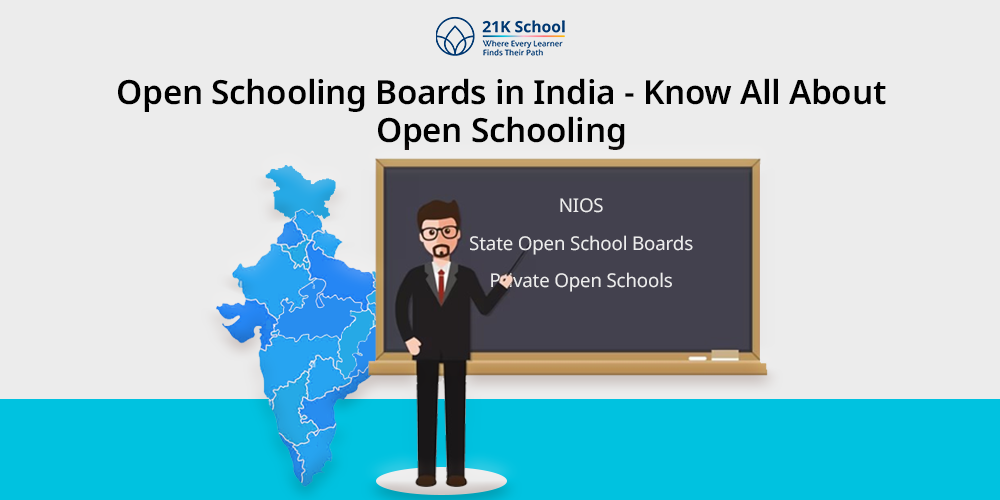

Open Schooling Boards in India – Know All About Open Schooling

In a large populous country like India, the traditional school system is unable to accommodate diversified needs of learners. Rural… Read More

15 Parenting Tips for Preschoolers: Building a Strong Early Foundation

Have you ever thought about how parents play an essential role for preschoolers? Parents can encourage their kids to learn… Read More

What Is The Right Age For Preschool: A Complete Parent’s Guide

Many parents find it hard making the decision of when to send their child to preschool. So, what you want… Read More

Preschool vs Kindergarten: Top Differences and Importance

Early childhood education is very important in the development of a child, both in learning and in their behavior. Parents… Read More

Preschool Vs Daycare: Choose The Best for Your Kid

Parenting is a difficult journey especially when it comes to child education. As parents, everyone looks for the best for… Read More

4 Different Types of Streams in NIOS: A Complete Guide

Education nowadays has evolved so much. If you are thinking so, that’s TRUE. With time and growing needs, flexibility is… Read More